The Callisto Grand

Certificate in Operational Credit Excellence

Learn O2C and Credit for GBS, SSC and GPO the right way!

The Callisto Grand Certificate in Operational Credit Excellence is the only available source of essential holistic e2e upskilling for every Credit / O2C team.

Combining self- study and interactive mentoring sessions, the Certificate provides the knowledge and operational skills required to prevail over the daily challenges facing all teams: whether it’s setting up credit limits, collecting cash or managing disputes.

The Callisto Grand Mentoring sessions, led by highly experienced trainers, are dynamic and entertaining multi-sensory, interactive learning experiences combining video, text, diagrams, exercises and discussion in a live ‘TV’ format. These unique mentoring sessions expand on and explain the real time operational context of the self-study module content enhancing learner development and knowledge retention.

It is not one of the “pass and forget” courses!

Certificate Benefits for Companies

The Callisto Grand Certificate empowers individuals and organizations with the skills and insights to optimize their credit and O2C functions, resulting in:

Improved O2C/Credit KPIs and results

Lower attrition, Talent pipeline

Regular updates and new features

Budget friendly long term strategic partnership

One-time only payment if a full team enrolled

Professional qualification

CPD accreditation (Continuous Professional Development)

Flexible learning

Multi-media learning experience

Interactive mentoring sessions

Ongoing support

Free Credit Matters tickets for bigger purchases

Possibility for Mentoring on-site

Suitable for beginners AND leaders looking for a good base or a broader perspective

The Certificate in Operational Credit Excellence

MODULES INCLUDED IN THE LEARNING

(Every learner covers all of them within the course)

MODULE 1

What’s in Module 1: Best Practice Collection Cycle?

Module 1 explores why it is vitally important to Know Your Customer and Your Customers Customer and introduces the Best Practice Collection Cycle.

These are essential aspects to be shared with Sales, Finance and Business Operations Managers.

This is the first step to being a valued and equal partner in the business and on the road to being a Centre of Excellence.Test yourself with 10 revision questions.Study time 2 to 3 hours.

MODULE 2

What’s in Module 2: The Credit Policy?

More than 90% of all global trade is executed using some form of credit.

This module provides a definition of what Credit is, the different relationships and introduces that most essential document for business clarity and focus, The Credit Policy.

Included are handy PDF examples of The Credit Policy and Credit Procedures Manual,

Foundation Digital is a dynamic and entertaining multi-sensory learning experience combining video, text, diagrams and pdfs.

Test yourself with 10 revision questions.

Study time 2 to 3 hours.

module 3

What’s in Module 3: Portfolio Segmentation?

This module focusses on components for effective client credit limit review and detailed analysis of the ATB (customer portfolio) including segmentation and proven collection methodologies

Diagrams illustrate an effective O2C organization structure and we introduce 3rd parties as an essential part of the collection cycle

Included are a PDF Credit application Form and examples of Corporate Annual Reports.

Test yourself with 10 revision questions.

Study time 2 to 3 hours.

MODULE 4

What’s in Module 4: The Art of Communication?

This module explores the many methods of communication which lie at the heart of trade. Effective internal and external is aligned with knowledge beyond process. Communication and agreement of mutual needs between buyer and seller is not straightforward but are essential in ensuring prompt payment. O2C is not back office, a niche or a process but an essential contributor to business sustainability and growth. Key learning includes the introduction of the Working Capital, Balance Sheets, Profit and Loss and Cash Flow Statements. Included are PDF Financial Details including illustrations of Balance Sheets, Profit and Loss and Cash Flow Statements.

Test yourself with 10 revision questions.

Study time 2 to 3 hours.

MODULE 5

What’s in Module 1: Influencing Business Strategy?

Module 5 introduces confirmation that Credit / O2C should contribute business critical information at regular senior management meetings.

The Credit Sales relationship is enhanced by in depth understanding of Pareto Analysis, Root Cause Analysis and DSO Variation by Country.

Key learning includes the introduction of the Working Capital, Balance Sheets, Profit and Loss and Cash Flow Statements.

Included are videos and PDF’s illustrating DSO Variation, Root Cause Analysis and Problem Solving.

Test yourself with 10 revision questions.

Study time 2 to 3 hours.

MODULE 6

What’s in Module 6: Performance Measures & Analytics?

Module 6 looks at different types of attitude and approach to collections. You will be able to identify yours and confirm if it is the most effective. A unique feature of Module 6 is the interactive templates to a range of performance measures. Enter your own figures and perform comparative analytics.

At the end of this module you will clearly identify if you are close to World Class Standards.

If overdues are greater the 2.5% there is work to be done! Included are videos, PDF’s and Interactive Performance Measure formulae. Test yourself with 10 revision questions.

Study time 2 to 3 hours.

MODULE 7

What’s in Module 7: Terms & Conditions, Law & Regulation?

Module 7 emphasizes the need to understand your Terms and Conditions, how they align with legal process and what securities can hedge risk. In the coming years, you will encounter customers who can’t pay or won’t pay. It is essential to understand the basic securities, legal terms, processes and execution options available in the laws and regulations applicable to your area of responsibility.

This module provides easy to follow PDF’s introducing the most important debt collection procedures and security options for 36 countries. Completing this module will provide you with a tool kit and knowledge that will be of immeasurable value when you share it with your business colleagues.

Test yourself with 10 revision questions. Study time 2 to 3 hours.

MODULE 8

What’s in Module 8: Cross Border Trading, Brexit & EU?

Module 8 explores the extraordinarily complex business of Cross Border Trading especially outside the EU -the documentation required, import/export regulations and local customs that may impact transit.

You are invited to ask the questions, what legal recourse is available e.g. Uniform Commercial Code or World Trade Organization, Credit Insurance or other? Included are videos and PDF’s introducing essential cross border trade bodies. This module is essential for everyone connected with business outside of the European Union including planning for post Brexit UK. Test yourself with 10 revision questions. Study time 2 to 3 hours.

MODULE 9

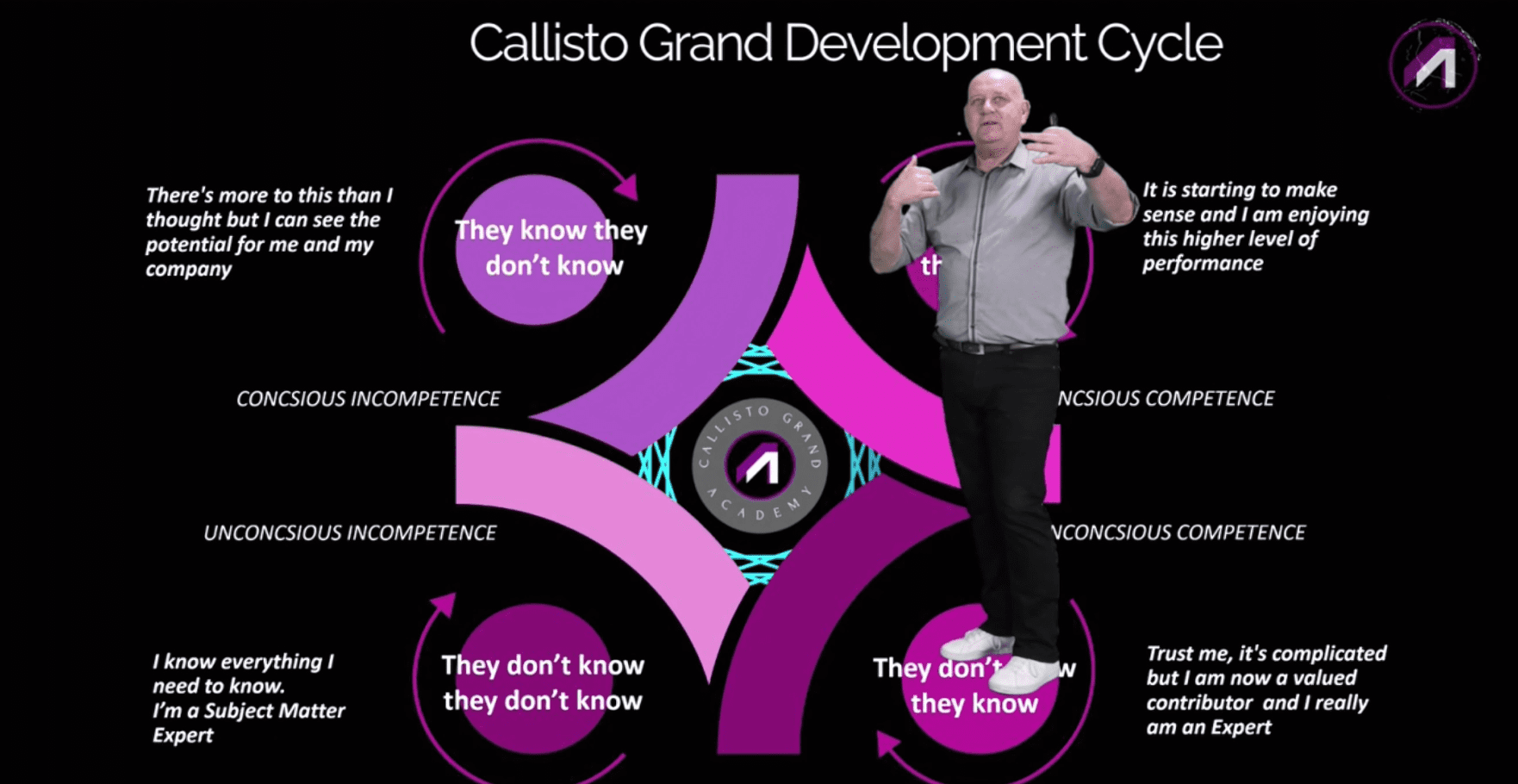

What’s in Module 9: Organization Structure & Effective Development?

This module focusses on the culture and components needed to develop high performing teams including succession planning and organizational structure. The Reputational Capital of your business investment in talent selection, development and retention form a major part of the Employer Branding Value Proposition. All employees will gain from the insights shared that are based on proven success in team building, removing silos and performance management. Test yourself with 10 revision questions.

Study time 2 to 3 hours.

MODULE 10

What’s in Module 10: Becoming the Change Leader from SSC to C OF E?

The content of this module explores the many sources of exciting opportunity that are within your grasp every day. Being involved in the SSC environment places you in the very epicentre of data from a vast range of sources. From Customer Master Files all the way through to reporting via Risk Management, Invoicing, Collections, Disputes, and Cash Allocation you are immersed in BIG DATA and a myriad of exciting opportunities. This section provides a range of interactive formula to check how well you are doing against the world class standards. Are you below 2.5% on overdues balances unapplied cash or staff attrition? If the answer is no to any of them, the start of the road to being the best starts here.

Test yourself with 10 revision questions. Study time 2 to 3 hours.

MODULE 11

What’s in Module 11: Incoterms, Brexit & The Future Unknown?

Module 11 focusses on Incoterms.

Many of you are responsible to credit sales outside of the European Union and perhaps haven’t been too exposed to the complex requirements. It appears likely that trading with the UK will be subject to a huge array of new trading conditions. This will impact you and all Credit /O2C in a huge way. It will not just be the Sales or Customer Service Teams that will need a strong understanding of Incoterms.

Your company, logistic partners and customers will all be faced with unfamiliar procedures that if not understood from the outset will lead to high volumes of invoice disputes. Test yourself with 10 revision questions. Study time 2 to 3 hours.

Certificate Benefits for Students

The students benefit as much as the companies. The list of the advantages for the O2C, Credit and AR team members includes:

Improved theoretical O2C & Credit knowledge

Practical experience, easily applicable to any Finance work

Ability to perform better and reach KPIs

Easier time getting performance bonuses

Increased chances for promotions or new roles

Job satisfaction

Meeting other peers working in Credit and O2C

Building confidence

Learning innovative thinking

Becoming data-savvy

Effective time management

Understanding the importance of AR roles

Possibility for Mentoring on-site

Opportunity to do something different than writing e-mails, replying on Teams and attendind Zoom calls 🙂

Successful learners will be equipped with the confidence, tricks and tips to achieve Best Practice Excellence in the form of 2,5% in 3 key areas:

CPD

Our course is Certified by CPD, a UK-based global organisation accrediting learning and development experiences, whether they are courses, workshop, webinars or diplomas. An example of another organisation using CPD and requiring its members to collect a quota of CPD points would be ACCA: if you are working towards ACCA or are a member already, our course will cover you for a year!

Other CPD points: Our conference also awards 20 hours of CPD accreditation for all who attend the full conference. Likewise, each of our 1hr webinars such as Credit & Collections Coffee Club and Credit Clinic award you 1 CPD point too.

The Right Choice

Incorporating these reasons into your decision to join a Global Credit Community can contribute to your professional growth, expand your knowledge base, and elevate your credit management expertise on a global scale. Whether it's on a GBS or a personal level.